End of Financial Year in MYOB Exo

MYOB Exo: End of Financial Year Guide

Get ready for the end of the financial year on March 31! This guide walks you through setting up the new financial year, rolling periods, and updating fixed assets in MYOB Exo.

Key steps include:

-

Check your version — Ensure you’re on a recent version for optimal performance.

-

Set up new financial periods — Define April to March periods and verify date ranges.

-

Roll the period — Tick “End of Financial Year” and choose whether to post transactions now or later.

-

Analytics setup — Create the new year in the Analytics module and load sales months.

-

Fixed Assets rollover — Finalise March depreciation before rolling into April.

Screenshots – EXO EOFY Screenshots_2025

Should you require any assistance please do not hesitate to contact us:

Categories

Relate articles

Coming back after the New Year break can feel overwhelming. You open your laptop and suddenly it’s all there, emails t...

Cyber Security in NZ: 5 Threats Businesses Must Prepare For

Cybersecurity in NZ has become one of the most pressing concerns for businesses of every size. Gone are the days when on...

Cyber Security 101 – From Reactive to Resilient 2025 Presentation

Click here: Cyber Security 101 – From Reactive to Resilient 2025 Presentation

We are here to help!

If you have an...

One Platform, Total Protection: How Fortinet Simplifies Business Security and Networking

Running a business is already complicated. Between looking after customers, managing staff, and keeping up with complian...

The Digital Roast Podcast: Season 3 — A Deep Dive into Cyber Security for SMBs

Cyber Smart Week is just around the corner, but at Focus Technology Group, we believe cyber security deserves more than ...

How Automation is Transforming Business Operations

In the latest episode of The Digital Roast Podcast, Christchurch Branch Manager and podcast host Ranae Dodds sits down w...

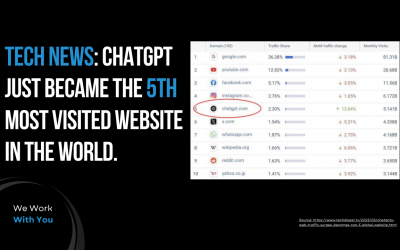

The AI Surge: Why ChatGPT’s Rise Signals a New Era for Information Access—and a Wake-Up Call for Businesses

In a world increasingly shaped by artificial intelligence, ChatGPT has skyrocketed to the forefront, now ranking as the ...