With the 2018.01 release comes some important compliance changes to become aware of.

Please refer to the release notes for more detail on changes and IR compliance.

Tax Updates

The compliance changes and features introduced in Exo Employer Services 2018.01 are listed below.

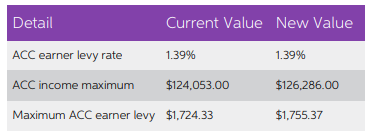

ACC Rates and Thresholds

Changes to ACC come into effect on 1 April 2018. MYOB Exo Payroll has been updated to incorporate the following changes:

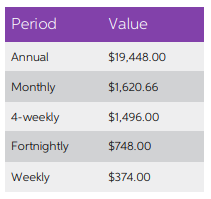

Student Loan Thresholds

This release updates the student loan thresholds for the 2018-2019 financial year. The new thresholds are:

Submission of IR348 Report

Inland Revenue is discontinuing support for C-Series EMS returns. This means that the IR348 report can only be submitted electronically via the myIR website – the report can no longer be submitted as a printed copy.

The IR348 report can still be printed for you reference – a warning message appears when selecting the “Final” presentation option, and the printed copy now includes notes in the header and footer indicating that the printed form cannot be submitted to the IRD.

Protected Net Earnings Calculation

IRD has issued new directions on how an employee’s protected net earnings (PNE) should be treated in cases where they have multiple Deductions to which a protected earnings threshold applies.

While Child Support Deductions have a 60% PNE threshold, it is possible for an employee to have other Deductions for District Court attachment orders – these also have a PNE threshold, which can be 60% or more, depending on the conditions of each attachment order. The IRD has specified that Child Support should be deducted from employee’s pay first, then attachment orders, then any other voluntary deductions (which generally do not have a PNE threshold).

Exo Payroll now processes deductions in the specified order, which means that if the pay is not enough to cover all deductions that are subject to PNE before the threshold is reached, the deductions at the top of the list will be deducted in preference to those below – see the example on page 6 for more details.

Note: This represents a potentially significant change to how employee’s pays are processed. We recommend that you review all employee’s pays, taking into account their financial situation and the deductions that apply to them.

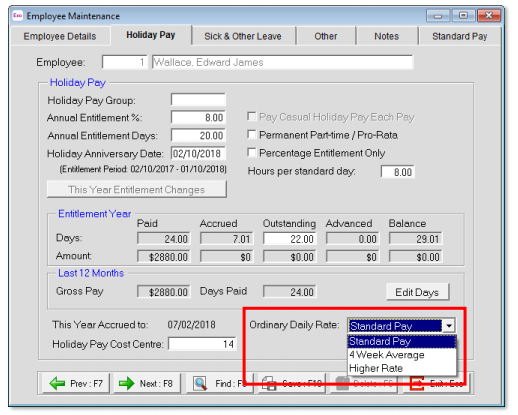

“Higher Rate” Ordinary Daily Rate

This release adds the ability to set an employee’s Ordinary Daily Rate for Holiday Pay as the higher of their Standard Pay rate or four-week average rate. A new “Higher Rate” option is available in the Ordinary Rate dropdown on the Holiday Pay tab of the Employee Maintenance window:

Need any assistance?

To find out more read the full release notes here. Alternatively, give our support team a call on 0800 12 00 99 or email to find out more.