Many clients are not aware of the Accountant’s Assistant module. As part of the MYOB Exo licencing structure a single Accountant’s Assistant licence is included for every client, meaning your external accountants can access and review your data without the need to use a Core licence. Additional user licences can be purchased if required.

So, let’s have a look at the set up and what’s available within the Accountants Assistant module…

The Exo Accountant’s Assistant interface is divided into the following sections:

- Business Checklists – a set of dashboard widgets containing checklists for important accounting processes.

- Financial Review – a set of financial reports that show key metrics for business owners and external advisors.

- Systems Integrity – a set of checks against the database and ledgers to ensure that Exo Business is balanced.

Business Checklists

The Business Checklists section of the EXO Accountant’s Assistant displays a set of checklist widgets for important accounting processes. By default, checklists for the following processes are displayed:

- End of Period

- End of Year

- Tax Return

Each checklist represents the best practices recommended by MYOB for those processes. These checklists are all context-sensitive to the period selected from the Financial Period control on the Accountant’s Assistant.

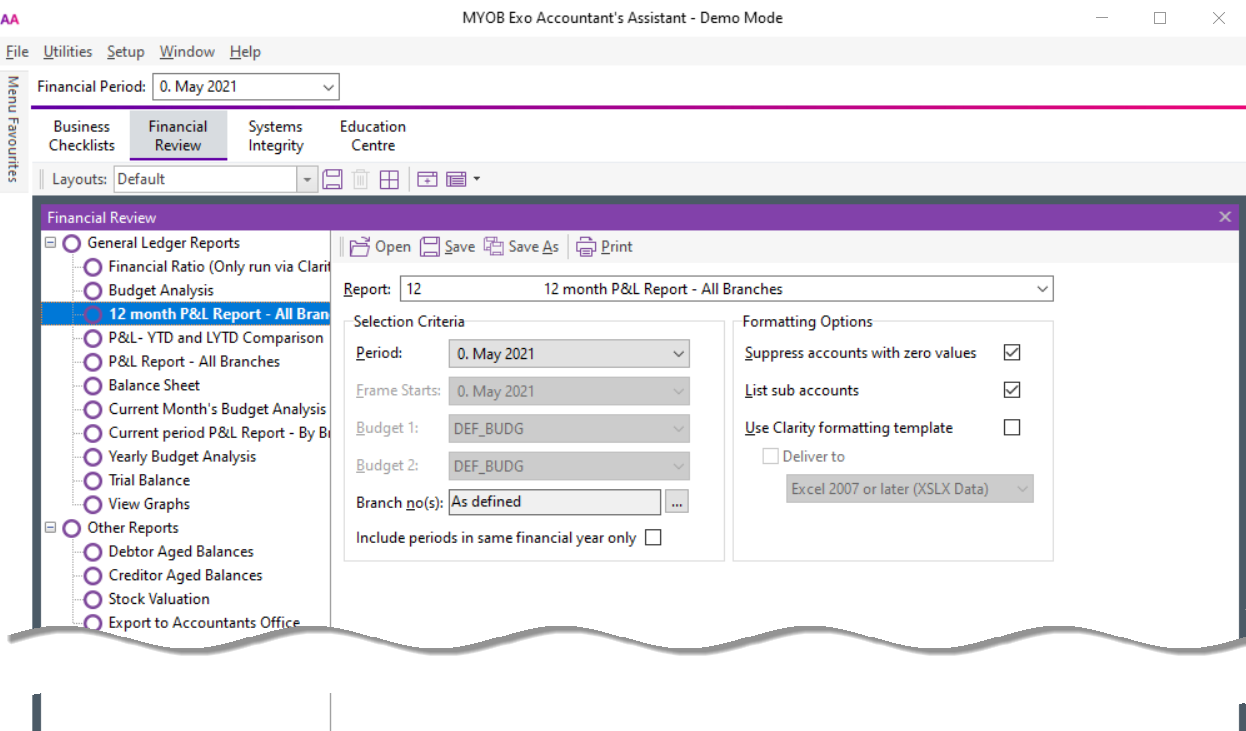

Financial Review

The Financial Review section of the EXO Accountant’s Assistant contains a standard package of financial reports that show key metrics for business owners and external advisors:

This tab also includes an export function, allowing General Ledger accounts and transactions to be exported in a format that can be imported into the MYOB Accountants Office system.

Systems Integrity

The Systems Integrity tab displays a set of checks against the EXO Business database and ledgers to ensure that the system is balanced and healthy. The following utilities are displayed by default:

- Ledger Reconciliation

- Data Verification

- Tax Exceptions

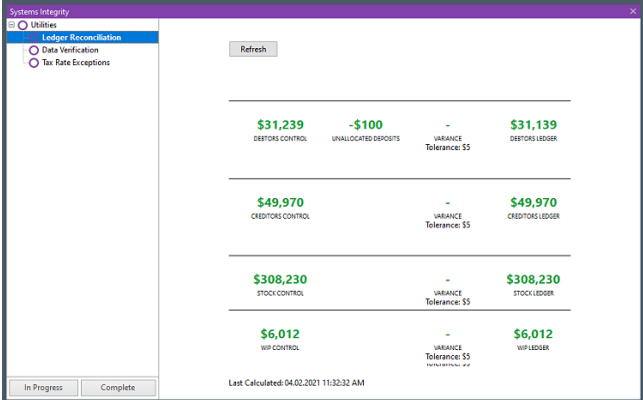

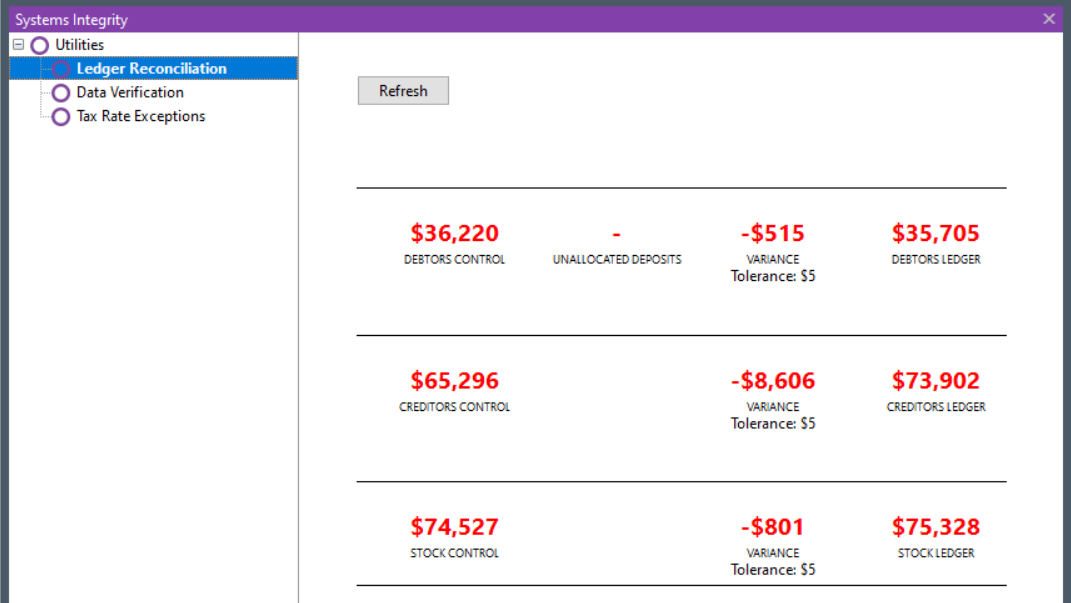

Ledger Reconciliation

The Ledger Reconciliation utility provides an overview of the status of each EXO Business sub-ledger:

Sub-ledgers that are green are in balance with the related control account; red sub-ledgers are not. The status of each sub-ledger is determined using the reconciliation reports (GL Payables Reconciliation, GL Receivables Reconciliation and Inventory Value Reconciliation).

Each area of the report can be clicked on to drill to more information:

- Clicking on a total for a control account opens the General Ledger Account Details window, displaying the relevant control account (Stock, Debtors or Creditors).

- Clicking on the variance amount for a sub-ledger icon and the General Ledger icon opens the relevant Reconciliation Exceptions report.

- Clicking on the total for a sub-ledger opens the relevant Reconciliation report.

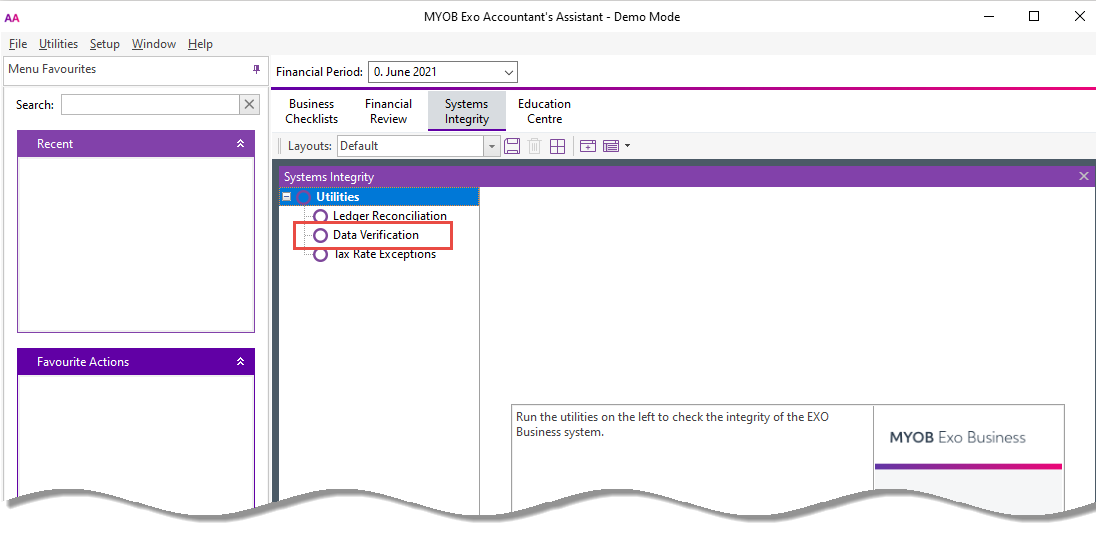

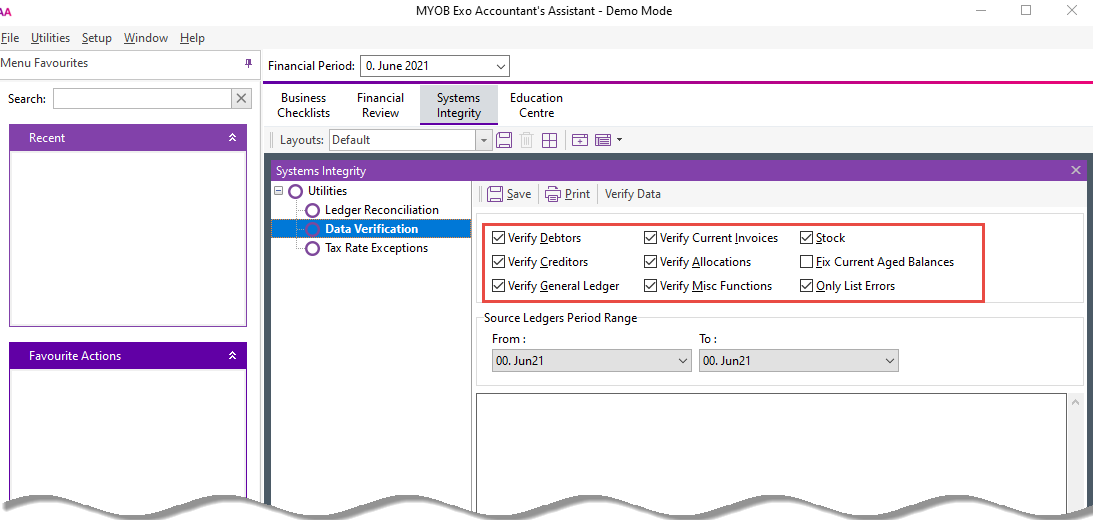

Data Verification

MYOB Exo Business can perform tests on the transactions in the database to highlight errors and suggest what may be causing them. Click on Data Verification:

From here you can select any number of areas to verify:

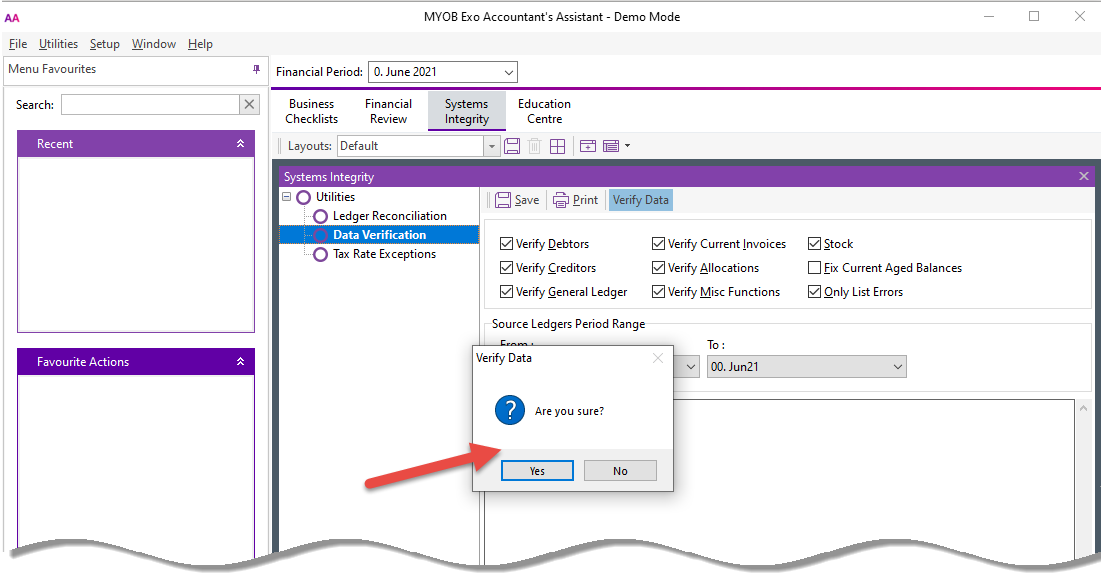

Then click on Verify Data, you will be prompted to confirm:

You can also run the Data Verification utility from the Exo Business Configurator under Utilities > Others > Exo Config Verification.

Tax Reports

Use the Tax Return functions under Tax Reports on the Reports menu to generate the tax return (specific to the country). This is complemented by the Tax By Rate Type and Tax Rate Exceptions reports. You can also use the Tax Rate Exception Report menu item to highlight invoices where the tax rate is not relevant to the transaction type.

Tax Returns

These Tax Return reports are available:

- New Zealand GST Return

- BAS Tax Return

- Singapore GST Return

- VAT Return

- Taxable Payments Annual Report

On each report, select Edit Return to select and edit previous returns.

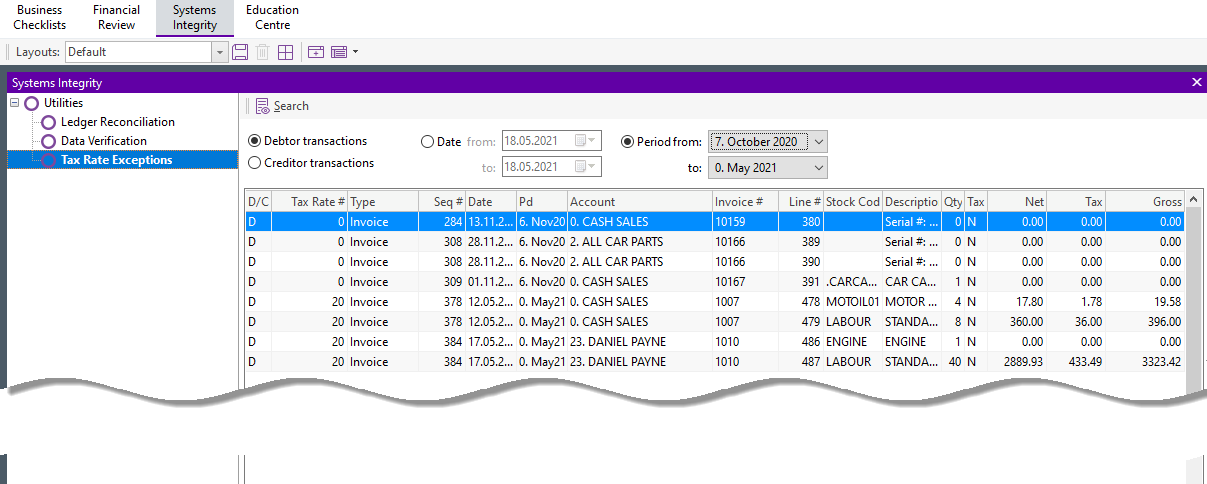

Tax Exceptions

Use the Tax Rate Exception Report menu item to highlight invoices where the tax rate is not relevant to the transaction type, using either a date range or a period range.

Financial Reporting

There are a range of inbuilt report options available within Accountant’s Assistant, predominantly General Ledger reports, there are a few others as well.

General Ledger Reports

- Financial Ratio

- Budget Analysis

- 12 Month P&L – All Branches

- P&L – YTD and LYTD Comparison

- P&L Report – All Branches

- Balance Sheet

- Current Month’s Budget Analysis

- Current Period P&L Report – By Branch

- Yearly Budget Analysis

- Trial Balance

- View Graphs

Other Reports

- Debtor Aged Balances

- Creditor Aged Balances

- Stock Valuation

- Export to Accountant’s Office

Clarity Report Browser

This can be added to the Accountant’s Assistant drop down menu to enable your Accountant to access more reports other than the standard inclusions.

General Ledger Report Writer

This, along with the Clarity Report Designer, can also be added to the dropdown menus, for experienced report creators, to allow creation of bespoke custom reports.