How to change Profit and Loss Accounts to Balance Sheet Accounts (Or vice versa)

Have you come to the end of the financial year and found that one or more of the accounts that you have been posting transactions to has been set up as a Balance Sheet account when it should be a Profit and Loss Account, or vice versa?

As part of the Monthly rollover at the end of the Financial Year, the balances of all Profit and Loss Accounts are transferred to the Retained Earnings Account and their balances are reset to zero. Because of this, it’s not enough to just change the setting on your GL account between Profit and Loss and Balance sheet.

Let’s look at two examples. In the first example, we have a Savings Account, which should be a balance sheet account, but has been set up as a Profit and Loss Account. In the second example, the Fuel and Oil Expense Account has been incorrectly set up as a Balance Sheet account. In both examples, we have rolled into a new financial year (commencing April 2012) since we started transacting in these accounts.

Example 1: Balance Sheet Account incorrectly set up as a Profit and Loss Account

(Note: You can follow these same instructions for Profit and Loss accounts that have been incorrectly set up as balance sheet accounts, but we have also included a separate example below)

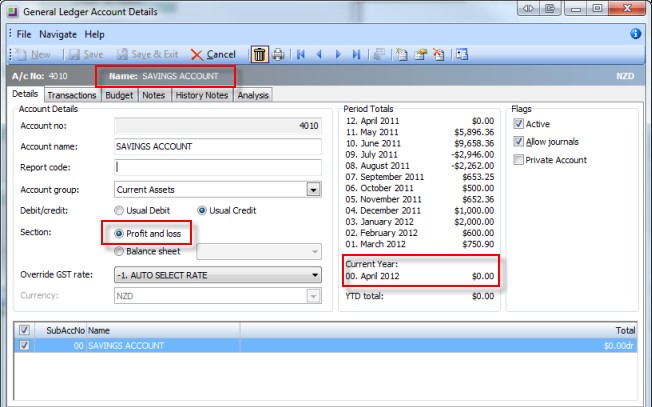

See the savings account below. Please note that since the End of Financial Year Roll Over has been completed the Savings Account’s current year balance is showing now as $0.00, and because it is set as a Profit and Loss account, each of the period totals is the sum of those months’ transactions (rather than a running balance).

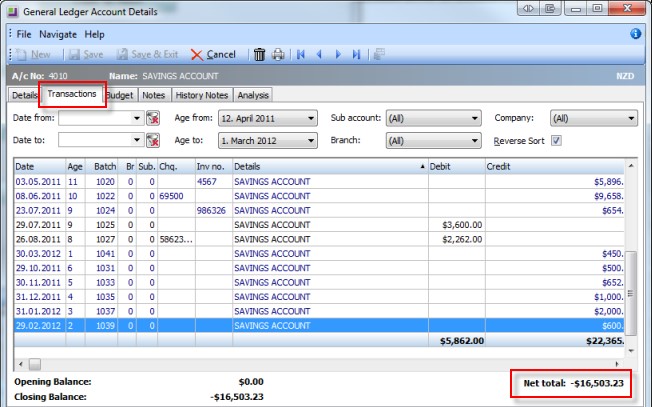

To change the account into a Balance Sheet Account, you first need to find out the total movement in that account, for each completed financial year. To do this, go into the Account Transactions tab and use the period selectors to list that entire previous financial year. If you use sub-accounts, select the sub-account as well. (You will need to repeat this for every sub-account on this account).

Along the bottom of the screen it will show the net movement for the year as the “Net Total”.

(If you have not rolled over to a new financial year since you started using this account, you will not need to do this. You can simply change the Account from Profit and Loss to Balance Sheet).

In the above example, the net movement is a negative figure, which means in accounting terms that it is a credit amount. (This is because this particular savings account is actually in overdraft!)

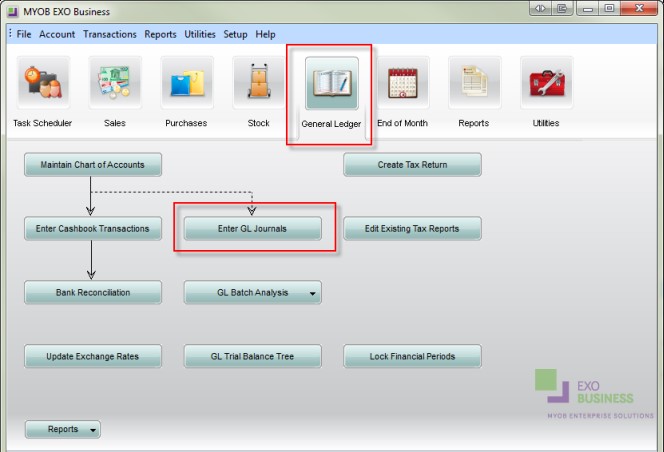

Once you have that balance recorded so you can refer to it, go to the General Ledger Tab and select the Enter GL Journals button.

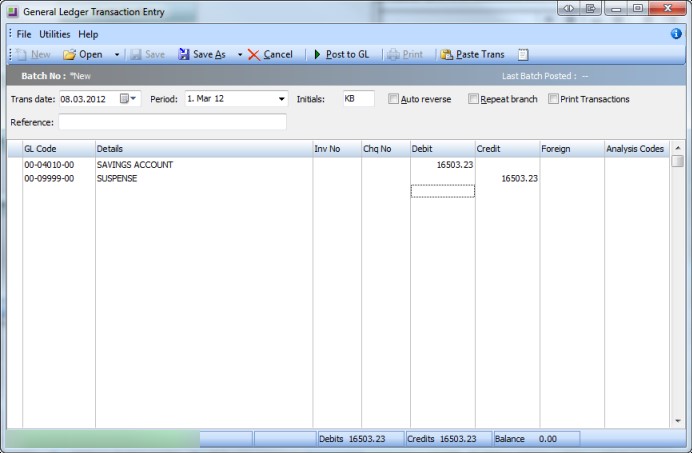

In the Journal, set the date and period back to the end of that previous financial year (you may have to unlock this period if it is already locked). Since the Savings Account is in overdraft (credit) you debit the previously recorded total and credit the Suspense Account (which we are using as the holding account for these transactions – this will be cleared again in the last step). Post to GL.

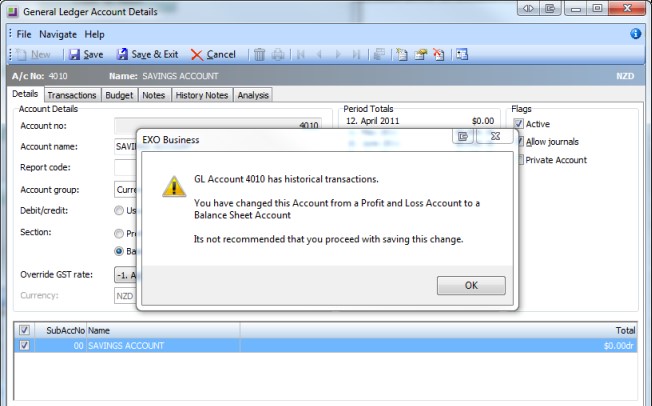

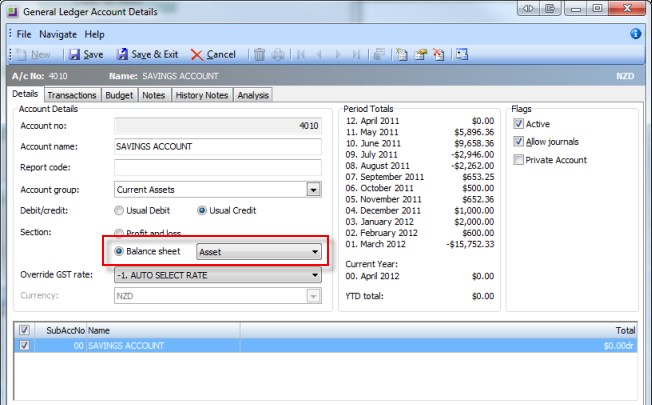

Return to the GL Account details and click the Balance Sheet radio button to change it from Profit and Loss. The following warning will appear; click OK.

Make sure you also assign it as an Asset, Liability or Equity.

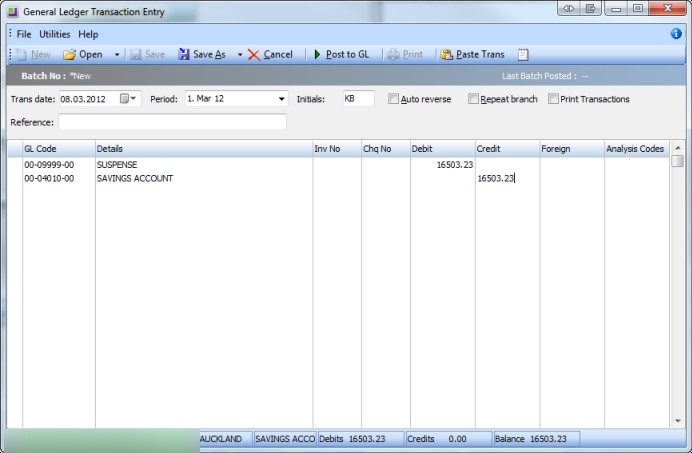

Now that you have changed over from Profit and Loss to Balance Sheet, you need to reverse the GL journal entry that you entered above. Go back into “Enter GL Journals” and enter all of the details exactly as per your previous journal, but make the debit a credit, and the credit a debit. I.e. in this example, create a debit from the Suspense Account and Credit of the same value back into the Savings Account.

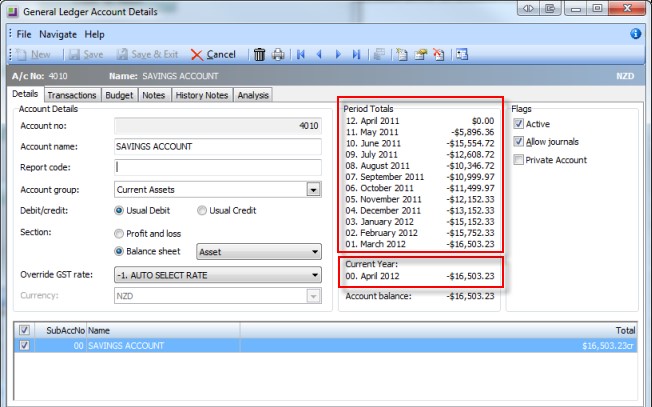

Once you return back to the Account details you will see that the Period Totals are now a running total and the Current Year shows the expected balance that we recorded originally. If these totals have not updated, please cancel out of the Account Details screen and open it again.

You have now correctly changed your Profit and Loss Account to a Balance Sheet account. Run your General Ledger Trial Balance or the GL Trial Balance Tree, and ensure that it balances.

Example 2: Profit and Loss Account incorrectly set up as a Balance Sheet Account

Firstly you need to find out the total movement for each previous financial year. To do this, you can follow the same steps that we took on the first example, but in this example, we can take a bit of a shortcut – since there’s been only one financial year end since we started using this account, and the because the account is currently showing a running balance, we can take that running balance at March 2012 of $5,198.66 (Debit) as the net movement for the year.

(Note: if you have sub-accounts, select one sub-account at a time).

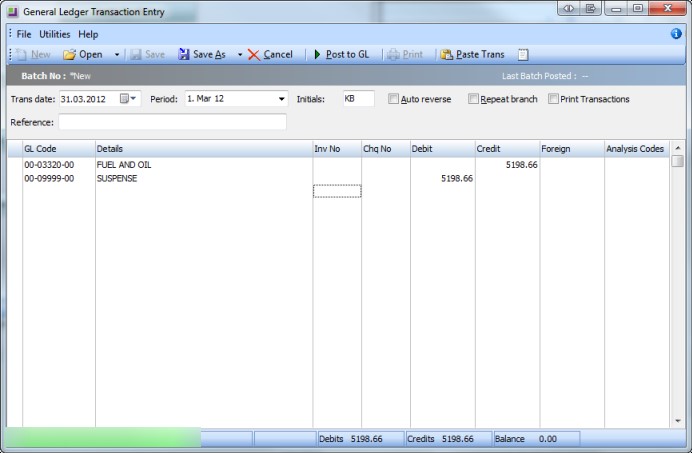

Enter a GL Journal. This time (because the amount above is a debit), credit the total from the Fuel and Oil Account and debit the same value into the Suspense Account. Post to GL.

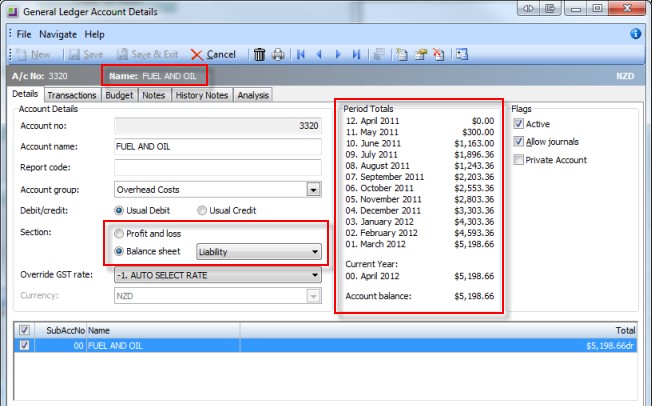

In this example, our Fuel and Oil expense account has been incorrectly set up as a Balance Sheet Account.

The steps to take to correct this are exactly the same as for the balance sheet account above. Let’s work through it anyway.

You will notice that the account has not had its balance sent to the Retained Earnings Account, and is showing the running total each month rather than a monthly total.

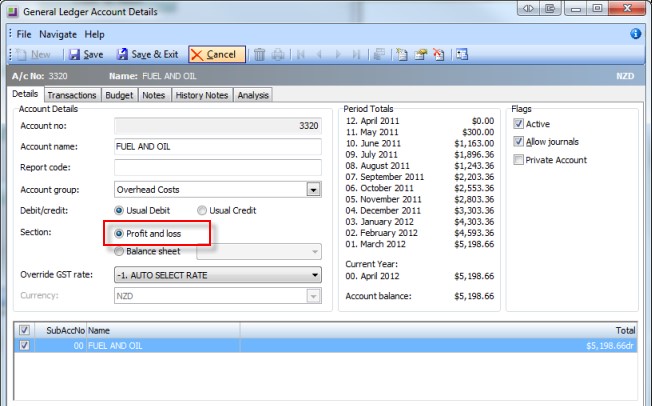

Return to the Account Details and change it now to a Profit and Loss Account, you will get the same warning pop up as we displayed earlier. Click OK.

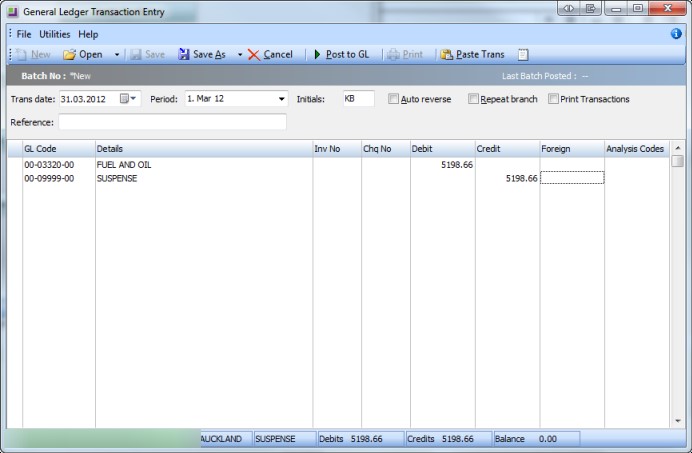

Enter another GL Journal, reversing your previous entry; i.e. debit the total from the Fuel and Oil Account and credit that amount from the Suspense Account.

You have now correctly changed your Balance Sheet account to a Profit and Loss Account. Run your General Ledger Trial Balance or the GL Trial Balance Tree, and ensure that it balances.