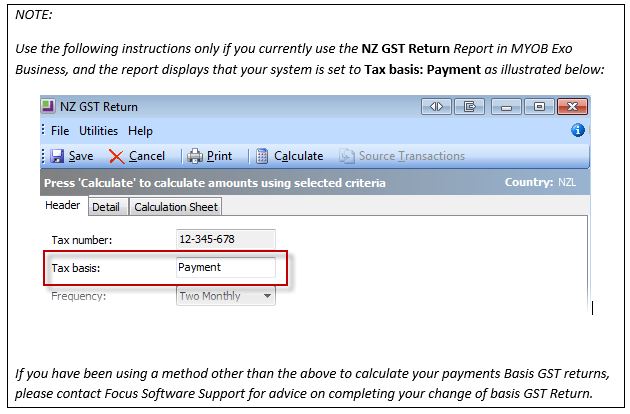

NZ GST – Change of Accounting Basis from Payments Basis to Invoice Basis

Once the IRD has approved a change in Accounting basis for your GST return from Payments basis to Invoice basis, there are a few things you will need to do both on your next GST return, and in MYOB Exo Business, to enact the change.

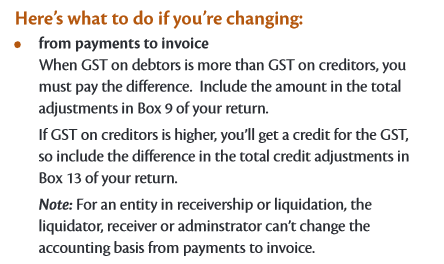

Firstly, you need to complete one last GST return with MYOB Exo still set on Payments basis, but on that GST Return, you need to make two adjustments on the Calculation Sheet tab for change of accounting basis. The following paragraph from page 5 of the IRD’s GST plus Guide (IR 546) explains these adjustments as follows:

The IRD will instruct you as to which GST return this adjustment is to be made in.

The adjustments to be made on the Calculation Sheet tab are as follows. These are one-off adjustments.

We will explain how to ascertain and enter the correct values for these adjustments later in this article.

Steps to prepare your GST return and adjustment

1. Print the Debtors Aged Balances report as at the end of the GST Return period.

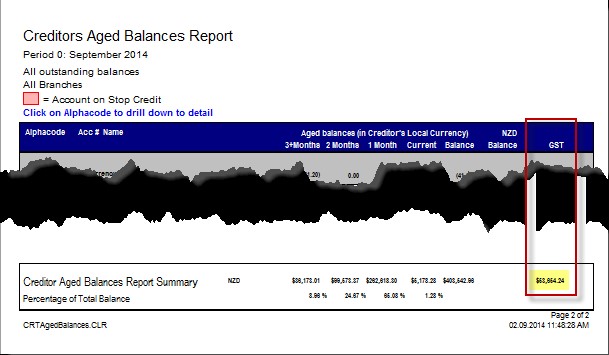

The column at the far right of the report is the GST on outstanding debtors. Go to the summary section at the end of the report and note the total. You will need to enter this in the Calculation Sheet tab in a later step.

Note: You will need the Focus version of the debtors Aged balances report (illustrated above), as the “out-of-the-box” MYOB Exo Debtors Aged Balances report does not have the GST column. If you do not have the GST column on your Aged Debtors’ report, please contact Focus Software Support.

Note: Period ranges for GST Returns are normally based on a transaction date range, whereas the aged debtor and creditor reports are based on financial period ends. If your system is configured to allow any users to enter transactions in debtors and/or creditors where the transaction date does not match the financial period (e.g. Enter a creditor invoice dated 30/09/2014 but in the October 2014 period), you will also need to quantify the impact of transactions where the date vs period straddles the end of GST period. Please call Focus Software Support for assistance with this.

2. Repeat step 1 above but with the Aged Creditors Report.

3. Calculate your GST return for the period in MYOB Exo Business using the NZ GST Return function, just as you have always done in previous periods. (This return will still be calculated in Exo on Payments Basis).

Remember as always to tick the “Include previous” option before calculating the GST Return.

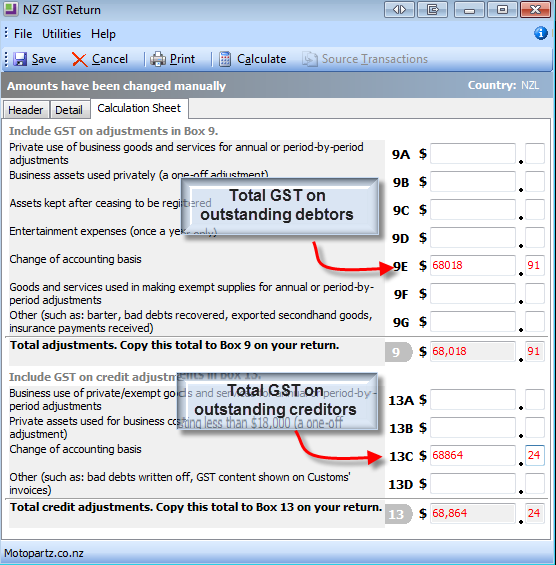

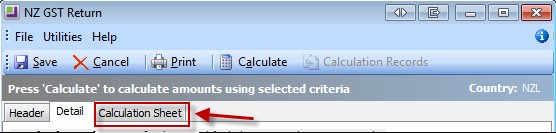

4. Click on the Calculation Sheet tab.

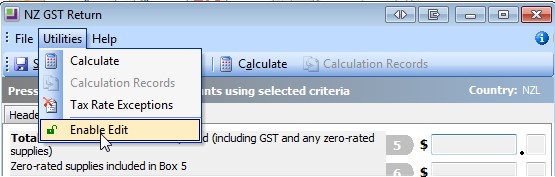

5. Select Enable Edit from the Utilities menu.

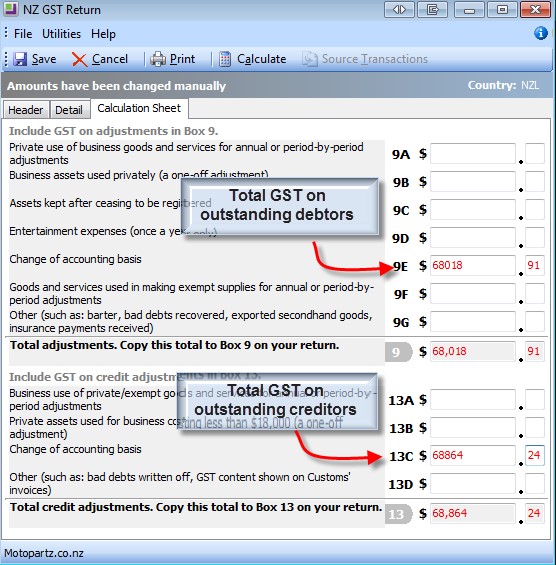

6. Enter the total GST from the Debtors and Creditors aged balances report printed in Steps 1 and 2, into boxes 9E and 13C respectively:

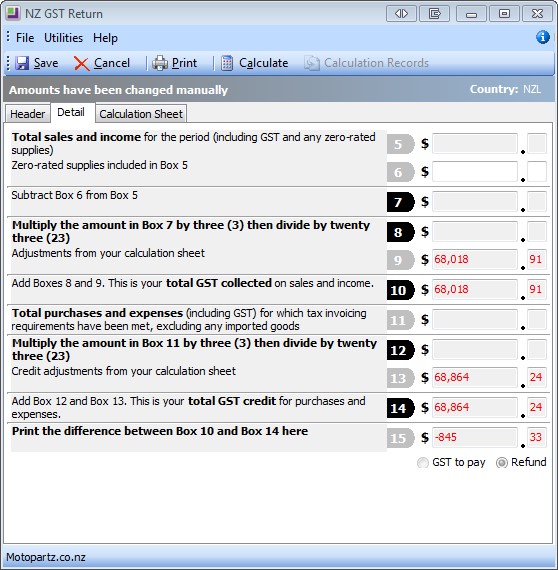

7. Return to the Details tab. The adjustments will be included in the total adjustments in boxes 9 and 13:

(Note: For clarity, the following illustration shows the adjustments only. In real-life, you will see values in the other boxes as well)

8. Save the GST return as per normal. This is your GST to pay/refund.

Next we need to change the GST return basis in MYOB Exo, and do a little housework to tidy things up prior to running the next GST return, which will be the first return fully on Invoice basis.

Steps to change to Invoice basis for subsequent returns

1. Ensure you have completed the final GST return on payments basis (as per the above) BEFORE completing any of the following steps.

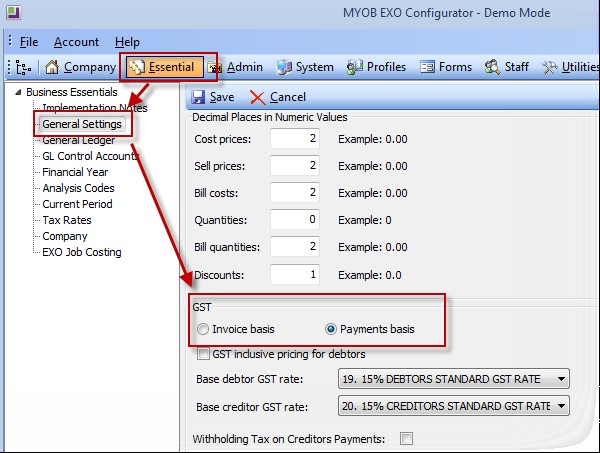

2. You will need Access to the MYOB Exo Configurator to complete this step. If you do not have access permissions to the Configurator, please contact your MYOB Exo System administrator.

3. In MYOB Exo Configurator, go to Essential > General Settings

4. Change GST from Payments basis to Invoice basis.

5. Click Save.

6. Exit out of the MYOB Exo Configurator.

7. Log back into MYOB Exo Business, or if you already had MYOB Exo Business open, go to the File menu and choose Refresh Settings. (This applies the change you just made in the Exo Configurator).

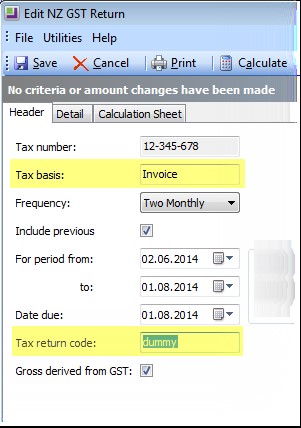

8. Now we need to create a “dummy” GST return to flag all invoices up to the end of the GST period (same period as above) as having been included in a previous return.

The reason for having to do this is that when you saved previous GST returns on Payments Basis, the GST Return code was saved against all of the payments that were included in the return – not the invoices. Now that future returns are looking for Invoices without a GST return code against them, the first return would include all invoices in history if we did not create this dummy return.

To do this:

a. Start a new GST Return.

b. Check that the Tax basis is now showing as Invoice.

c. Tick Include previous. (Note: you should always tick this option when preparing GST returns).

d. Fill in the date (and if applicable, period) range details exactly the same as the GST return you’ve just completed above.

e. Enter a unique Tax return code. In this example, we have used dummy as the tax return code (as this tax return will never be filed).

f. Calculate the return by clicking the Calculate button.

g. Save the return.

When the time comes, complete your subsequent GST returns as per normal. The system will calculate subsequent returns on invoice basis.