If staff are taking annual holidays that cover more than one pay period, and they want paid in advance, it’s important to set options to ensure correct tax calculations.

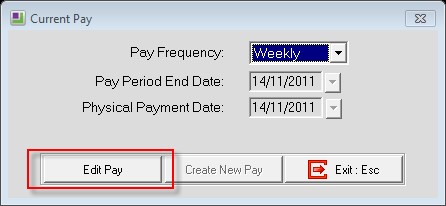

Enter Payroll. And open a Current Pay

Edit the selected Pay Period

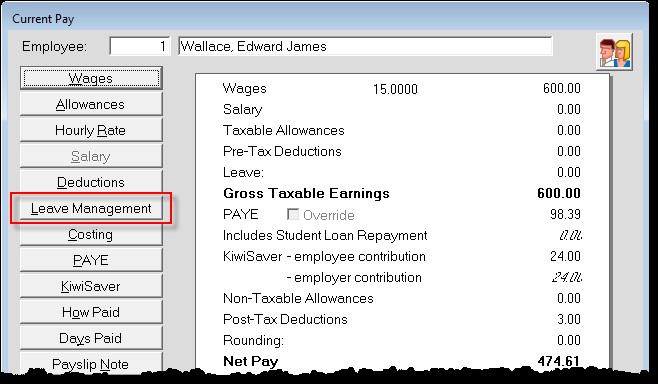

Select the Staff Member to be paid.

Within their Current Pay screen click on Leave Management

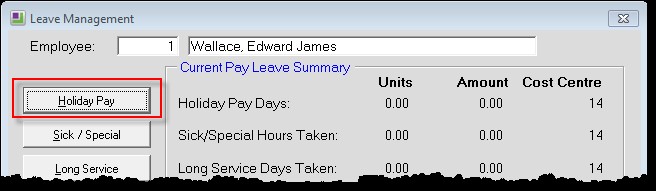

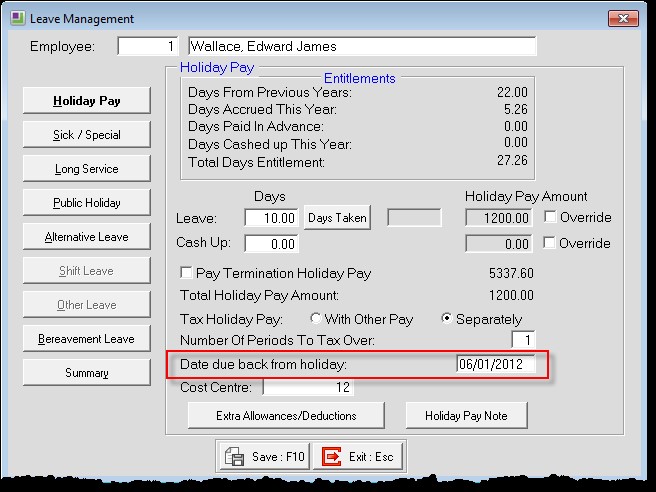

In the Leave Management Screen, click on Holiday Pay

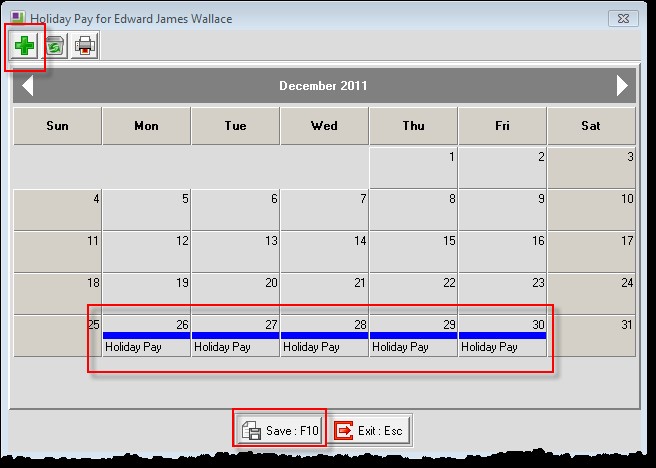

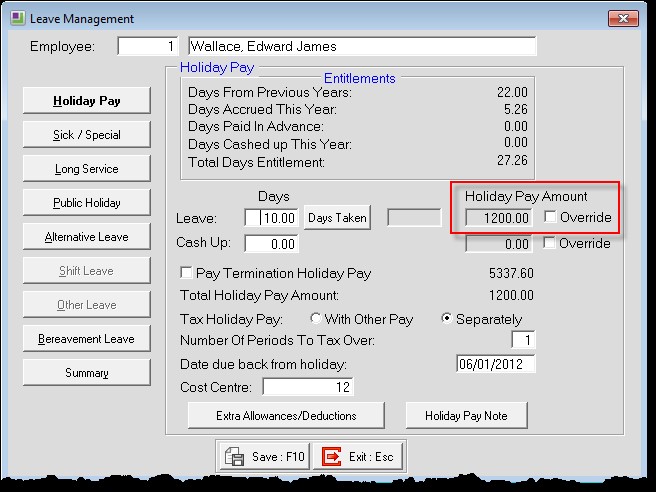

The resulting screen shows Entitlements (refer to glossary for fuller explanation of terms). Enter the amount of days or hours taken, and then click on Days Taken and record the actual days the staff member will be on annual leave.

Select the Days and click the Plus Icon to save them as Holiday days. To print the month for the current employee, click on the Printer icon.

This will auto populate the Holiday Pay Amount field.

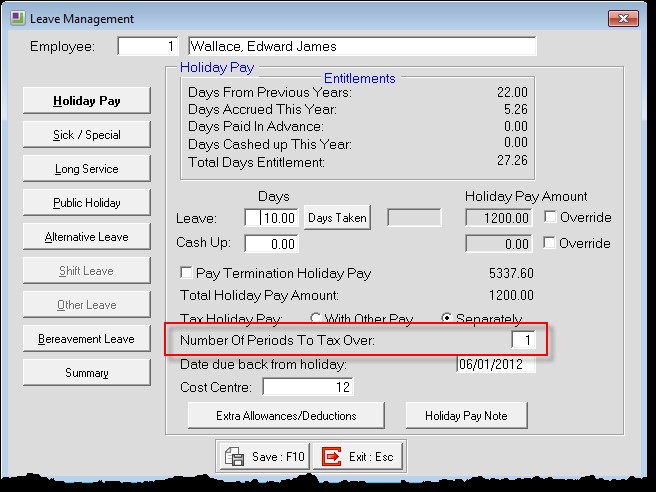

The ‘Number of Periods to Tax over’ will need to be updated to reflect the number of pay periods the employee is away for. For example if the employee is away for two weeks, and they get paid weekly then it would be two pay periods.

This ensures the correct tax rates are applied.

Enter a Date due back from Holiday. This will stop the employee showing up in the normal pay periods, until they return.

Glossary of Terms

- Amount from Previous Years: Outstanding holiday amounts from previous holiday pay years

- Amount Accrued this Year: Holidays accrued in the current year

- Amount paid in Advance: Holiday amount the employee has taken from the accrued amount this holiday pay year

- Days/Hours Cashed up this year: The number of days that the employee has chosen to ‘Cash up’ this holiday pay year.

- Accrued Amount: This field is automatically calculated by the Payroll, as pay periods roll over.

- Outstanding Days/Hours: The numbers of days/hours of holiday pay owing and still outstanding from prior to the last anniversary date. This value is calculated automatically as pays are run and as holiday pay years roll over.

- Outstanding Amount: The lump sum of holiday pay owing and still outstanding from years prior to the last anniversary date, for an employee who is on the Percentage Only method. This value is calculated automatically as pays are run and as holiday pay years roll over.

- Advanced Days/Hours: The number of days/hours of holiday pay that has been paid in advance of the next Holiday Anniversary Date. This value is calculated automatically as pays are run and as holiday pay is paid out of the employee’s current year’s accrual of holidays.

- Advanced Amount: The lump sum of holiday pay that has been paid in advance of the next Holiday Anniversary Date, for an employee who is on the ‘Percentage Only’ method. This value is calculated automatically as pays are run and as holiday pay is paid out of the employee’s current year’s accrual of holidays.

- Days/Hours Balance: Calculated at the accrued days/hours + outstanding days/hours – advanced days/hours.

- Amount Balance: Calculated at the accrued amount + outstanding days/hours – advanced amount, for an employee who is on the ‘Percentage Only’ method.